34+ does mortgage affect credit score

Lets assume youre borrowing 200000 with a 30. Web Paying off a mortgage could impact the length of your credit history as well as your credit mix.

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

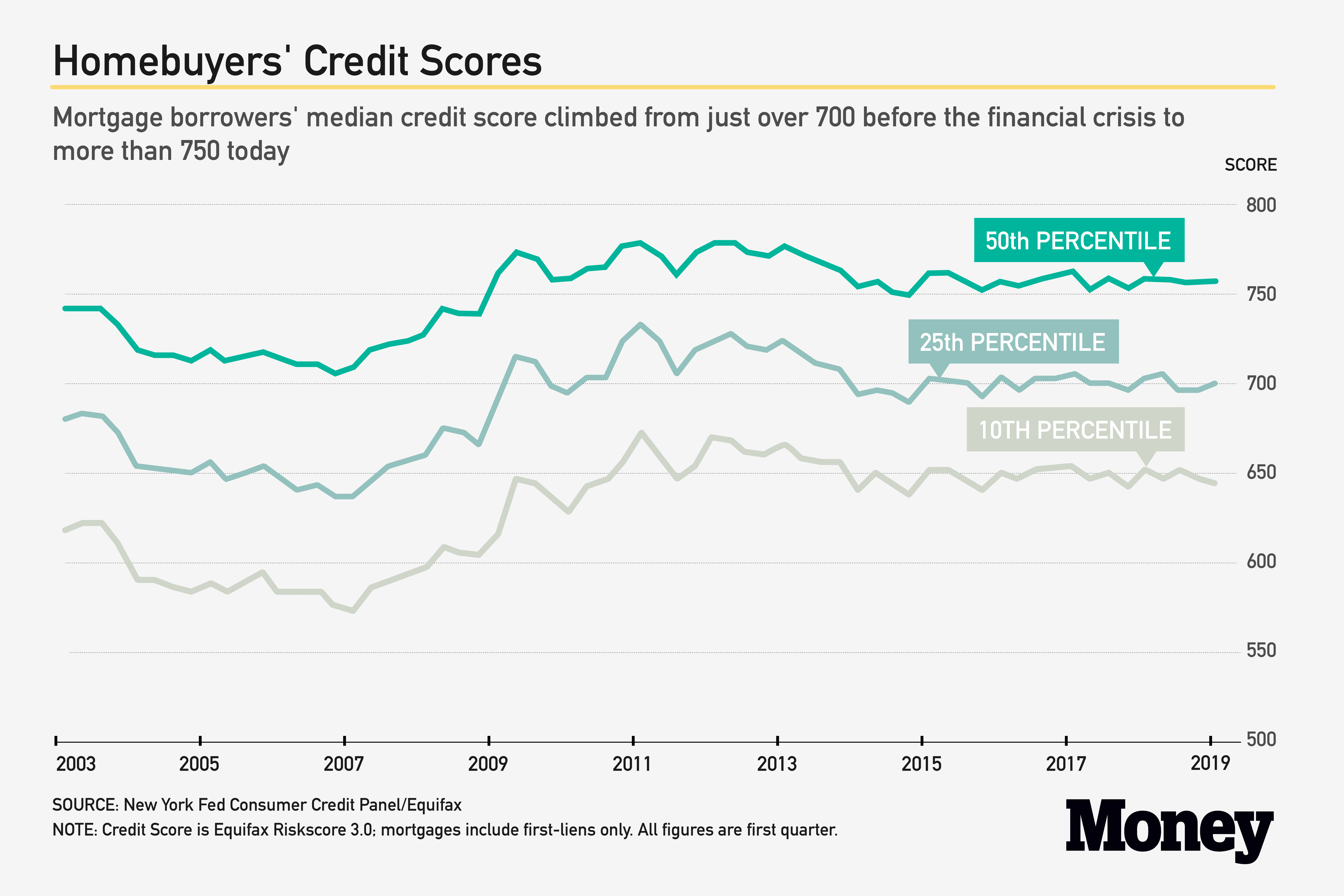

Having a good credit score either a FICO score of 670 or a VantageScore of 660.

. Web The difference between a good and great score can still add up over the life of a loan. With a Low Down Payment Option You Could Buy Your Own Home. Web A study by LendingTree found that US.

Compare Lenders And Find Out Which One Suits You Best. Points arent taken away because you dont have a mortgage. Web As Bane explains Those are going to be much more flexible on credit score With FHA loans borrowers can technically have scores as low as 500.

Web It can help you determine the down payment you need to buy a home at the price point you want. Ad Calculate Your Payment with 0 Down. With a Low Down Payment Option You Could Buy Your Own Home.

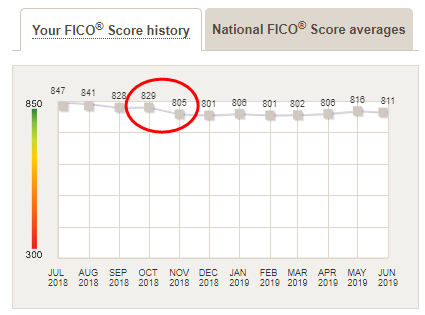

However you might gain some. Web Credit score calculated based on FICO Score 8 model. Borrowers saw an average credit score drop of 204 points after getting a mortgage.

Web Paying off any debt will certainly affect your credit score and your mortgage is no exception says Michael Mesa branch manager and certified mortgage. But if you use the funds obtained through the reverse mortgage. Compare Lenders And Find Out Which One Suits You Best.

If you dont have any long-standing accounts in your name other than. Comparisons Trusted by 55000000. Why Rent When You Could Own.

Web In the case of a 90-day late payment the range for the drops would have been 27 to 47 points and 113 to 133 points respectively. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web WalletHub Financial Company. Looking For Conventional Home Loan. It took an average of 165 days after.

Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score. During the mortgage preapproval process lenders do a hard. Web Not having a mortgage doesnt hurt your credit scores it just doesnt help them.

Web This is the biggest myth there is with your creditA new inquiry will hurt your score less than 5 points on average. Assuming nothing in a mortgage application changes except the credit score. Ad Tired of Renting.

Looking For Conventional Home Loan. Ad 5 Best Home Loan Lenders Compared Reviewed. A reverse mortgage does not affect your credit score on its own.

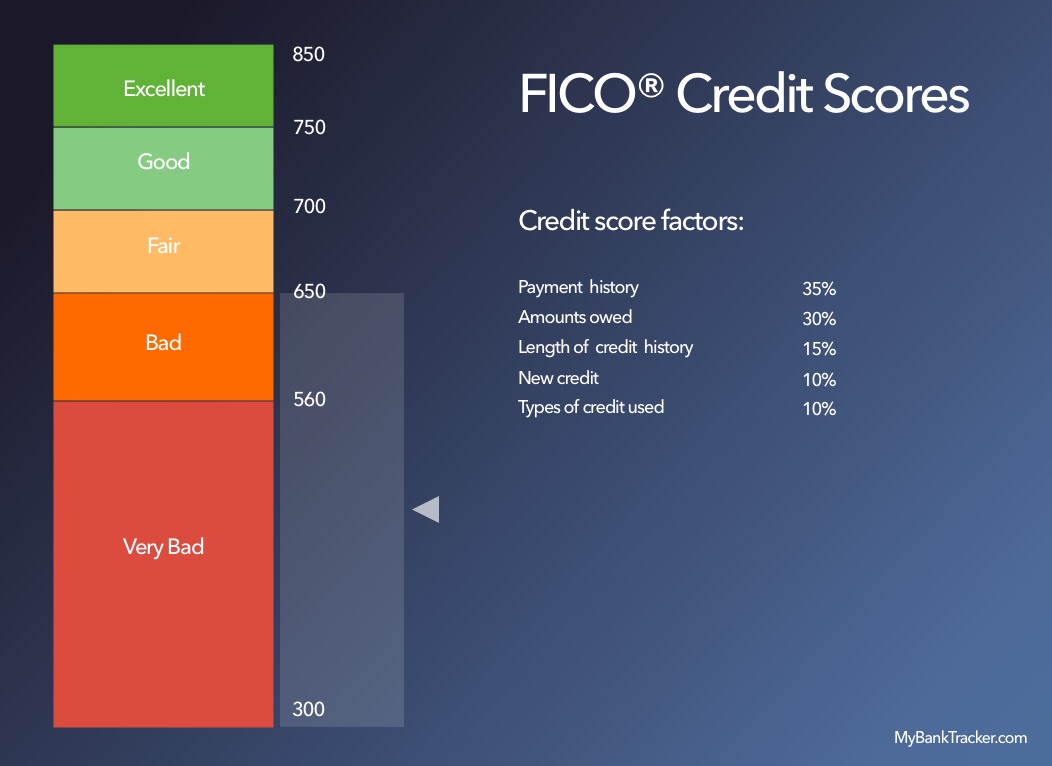

Web How your credit score affects your chance of getting a personal loan. Web You can either take our word on how your credit score affects your mortgage rate or you can check out this chart. So the person with a credit score of.

Comparisons Trusted by 55000000. The drop is temporary as the inquiries. The pre-approval typically requires a hard credit inquiry which decreases a buyers credit score.

Web A mortgage pre-approval affects a home buyers credit score.

Does A Mortgage Hurt Your Credit Score Experian

What Credit Score Is Needed To Buy A House

Bad Credit Home Loans How To Buy A House With A Low Credit Score

Here S How Long It Takes To Improve Your Credit Score

This Is The Credit Score You Need For A Mortgage Money

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

What To Consider Before Refinancing Student Loans Mybanktracker

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

How Credit Score Affects Your Mortgage Rate Nerdwallet

What Credit Score Do You Need To Buy A House Palmetto Mortgage Of Sc Llc

My Credit Score Dropped This Much After I Paid Off My Mortgage

How Prepaying Your Mortgage Affects Your Credit Score

What Is The Meaning Of Your Credit Score Credit Sesame

What Is The Minimum Mortgage Credit Score In Michigan

What Credit Score Do I Need To Get A Mortgage National Credit Federation

Check Your Credit Score Before Buying A Home

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds